How to Avoid Common Self-Assessment Mistakes in the UK

Avoid penalties, stress, and last-minute errors—learn the most common Self Assessment mistakes UK taxpayers make and how to get it right every time.

How to Legally Reduce Corporation Tax in 2025

With Corporation Tax rates currently varying from 19% to 25% based on profit levels, it is increasingly crucial for UK businesses to comprehend how to manage their tax obligations. The positive aspect? There are entirely legal methods to decrease your Corporation Tax expenses—without raising any concerns with HMRC.

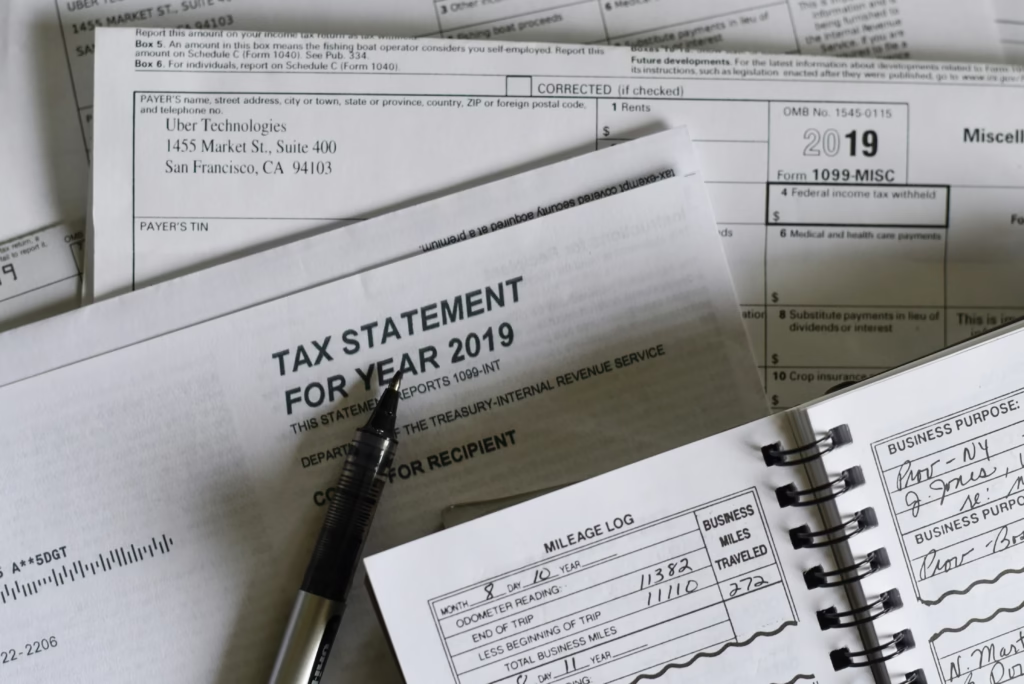

Is Your Side Hustle Prepared for Tax Season? Essential Information for Every Freelancer

Freelancing and side hustles have surged in popularity throughout the UK—whether you are creating logos, providing online tutoring, or selling handmade items on Etsy. However, many new freelancers tend to overlook one crucial aspect: taxes.

Is Your Small Business Missing Out on Potential Earnings? Key Tax Reliefs You May Not Be Aware Of

Operating a small business in the UK requires careful financial management—but are you taking advantage of every financial benefit available to you? Numerous business owners overlook essential tax reliefs simply due to a lack of knowledge regarding their eligibility. At Melon Accountants, we assist small businesses in identifying and utilizing these savings to enhance their profitability.