UK VAT compliance is often complicated and time–consuming. Being a sole trader, limited company, or expanding company, Melon Accountants offers complete VAT return services so that you stay within HMRC compliance and are able to recover maximum VAT.

Our services extend from VAT registration at the outset and diligent bookkeeping to quarterly returns and continual compliance assurance. Our Chartered Tax Advisers recommend the optimum VAT schemes (e.g., Flat Rate or Cash Accounting) best suited to your business profile, limiting liabilities and ensuring avoidance of costly errors.

* Compliance with HMRC regulations

* Avoidance of penalty and late fees

* Optimization of reclaimable input VAT

* Personalized VAT scheme advice and strategy

* Reassurance in experienced care

* UK VAT-registered businesses

* Limited companies and sole traders

* Importers and online retailers

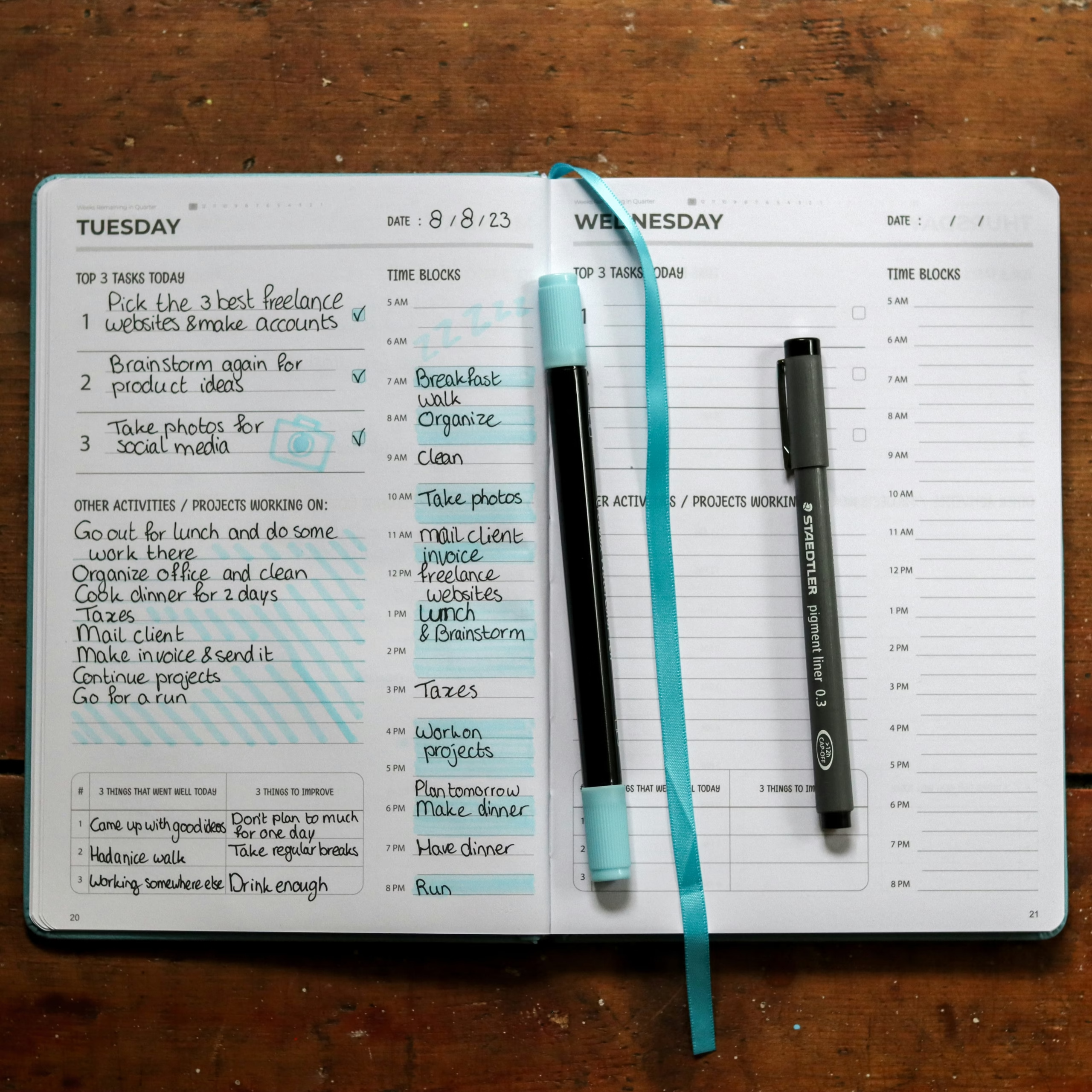

* Freelancers and consultants approaching the VAT threshold (£90,000)

* Those who want to outsource complex VAT reporting

VAT return preparation and filing (quarterly/monthly)

Review of VAT records and supporting documents

VAT scheme advice and compliance checks

HMRC liaison and representation

Timely reminders and deadline tracking

Quarterly – 1 month and 7 days after the end of your VAT period (e.g., for the period ending 31 March, the deadline is 7 May)

Sales and purchase invoices

Expense receipts

Bank statements

Previous VAT returns (if any)

VAT registration certificate

Explore examples of how we’ve made tax returns simpler and more accurate.

Example : Micro e-commerce business using Shopify and Amazon exceeds VAT threshold. Engage Melon Accountants for meticulous, online submission of VAT returns, reclaim input VAT on postage and packaging, with quarterly reconciliations that eliminate over-payments—over £1,200 per year saved.

Have a query about our services, pricing, or how we work? We’ve compiled the most common questions our clients ask — all in one place. If you still need help, don’t hesitate to reach out directly.

General FAQs

Tax & Business Services

Payroll & Bookkeeping

Our head office is in London, but we serve clients across the UK through cloud-based accounting platforms.

We work with leading cloud accounting platforms like Xero and QuickBooks.

Yes, we provide tailored accounting and tax services for a range of industries including construction, hospitality, healthcare, property, and startups. Our sector-specific expertise ensures advice that fits your business.

You can contact us via phone at 020 3950 8470, email at info@melonaccountants.co.uk, or through our website’s contact form.

Our bookkeeping services encompass data entry, bank reconciliations, accounts receivable and payable management, financial reporting, and VAT returns.

We manage real-time information (RTI) PAYE filing, email payslips to employees and employers, provide payroll cost analysis, advise on payroll-related issues, report to your auto-enrolment pension provider, and assist with auto-enrolment correspondence

Yes, we provide on-demand virtual finance director services to help businesses get the financial expertise they need without the cost of hiring a full-time CFO.

Certainly. We offer company formation and secretarial services, including advice on business structures, maintaining company registers, Companies House filings, and planning regarding different business entities.

Our head office is in London, but we serve clients across the UK through cloud-based accounting platforms.

We work with leading cloud accounting platforms like Xero and QuickBooks.

Yes, we provide tailored accounting and tax services for a range of industries including construction, hospitality, healthcare, property, and startups. Our sector-specific expertise ensures advice that fits your business.

You can contact us via phone at 020 3950 8470, email at info@melonaccountants.co.uk, or through our website’s contact form.